CEO SUMMARY: Not in recent memory has a laboratory information system (LIS) product been pulled from the market. That is why the announcement by GE Healthcare that it would no longer service or support its Centricity Ultra Laboratory product after July 23, 2013, has caused a stir within the healthcare informatics industry. In the United …

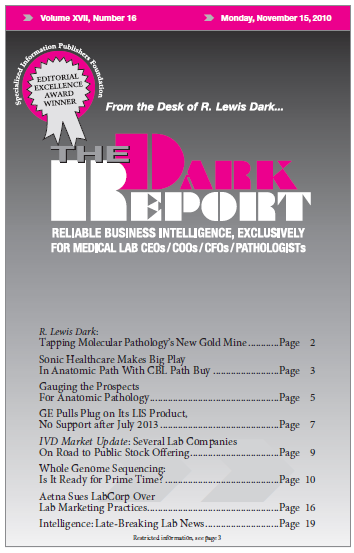

GE Pulls Plug on Its LIS, No Support after July 2013 Read More »

To access this post, you must purchase The Dark Report.