CEO SUMMARY: It’s an odd story. One of the nation’s most respected names in diagnostics quietly ceases delivering products—and no one in the laboratory industry pays much attention. Last month, Nichols Institute Diagnostics, acknowledging production problems it has not yet resolved, announced to its laboratory customers throughout the United States that deliveries of its diagnostic …

Nichols Diagnostics Stops Product Sales Read More »

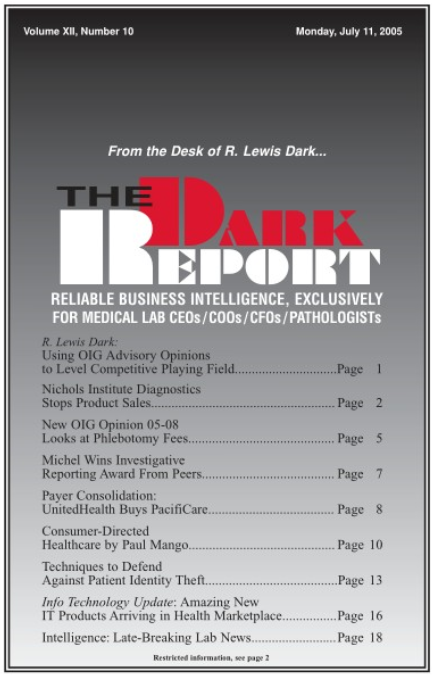

To access this post, you must purchase The Dark Report.