CEO SUMMARY: Assume that California’s Department of Health Care Services (DHCS) wins all challenges to enforcement of its interpretation of 51501(a). DHCS will get a one-time cash infusion as it collects money from labs which violated the state statute. But going forward, federally qualified health centers, independent practice associations, private payers, and patients will pay …

Who Wins and Who Loses With 51501 Enforcement Read More »

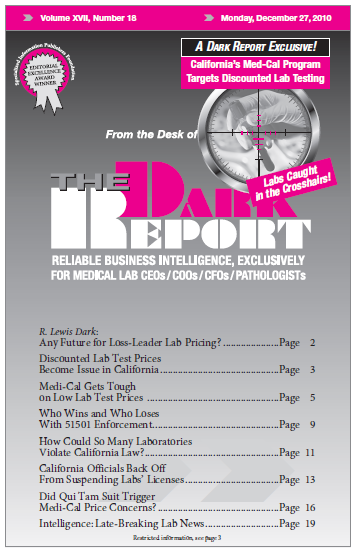

To access this post, you must purchase The Dark Report.