CEO SUMMARY: For several reasons, the “Protecting Access to Medicare Act” (PAMA) has the potential to be the most disruptive federal legislation directed at the clinical lab industry since the enactment of CLIA 1988. Following passage of the law, some lab industry groups have taken different stances toward the positive and negative elements of PAMA. …

PAMA’s New Rules Affect Lab Test Pricing, Coverage Read More »

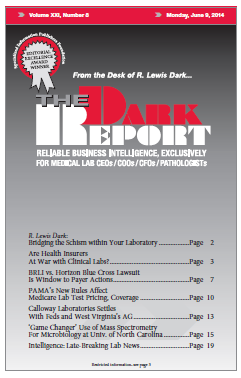

To access this post, you must purchase The Dark Report.