CEO SUMMARY: Each year since 2015, Medicare officials have posted the prices charged by every physician. That now makes it possible for pathology group practices to conduct a price study of their region and state to learn how their group’s prices compare with other pathology providers. A national pathology consultant points out that one way …

Medicare Data Makes Pathology Prices Public Read More »

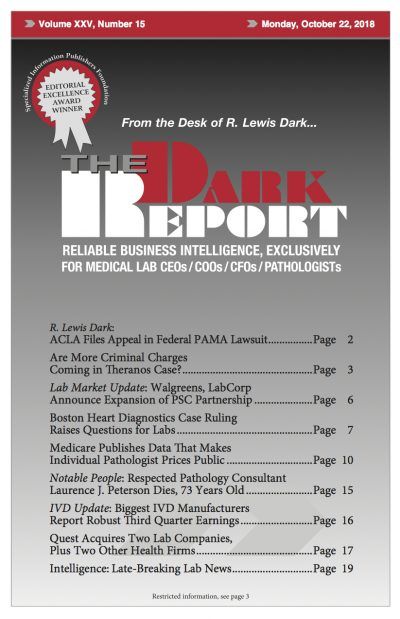

To access this post, you must purchase The Dark Report.