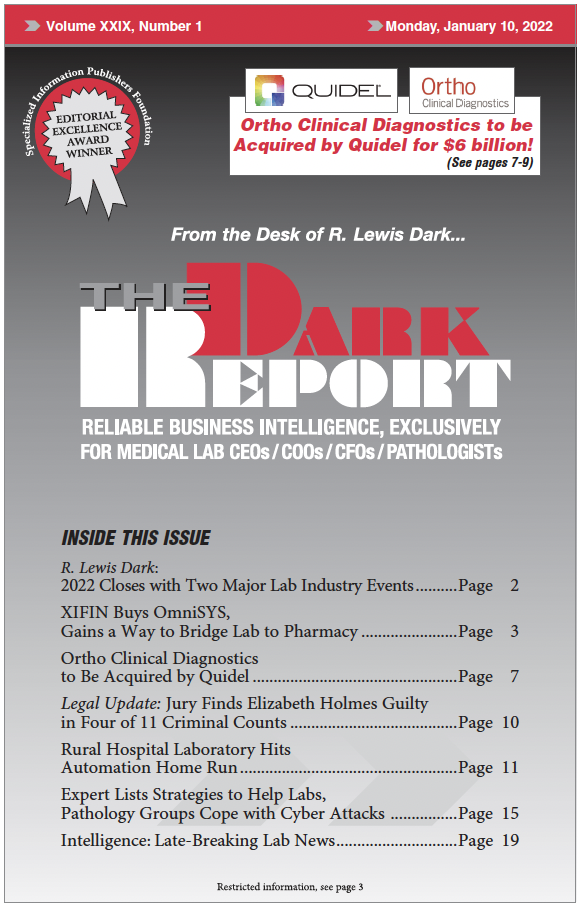

CEO SUMMARY: In an announcement released before the end of 2021, Quidel said it had signed an agreement to acquire Ortho Clinical Diagnostics (OCD) for $6 billion. Laboratories that are customers of either company should expect changes after the deal closes as Quidel moves to integrate OCD. One IVD expert says Quidel will become more …

Ortho Clinical Diagnostics to Be Acquired by Quidel Read More »

To access this post, you must purchase The Dark Report.