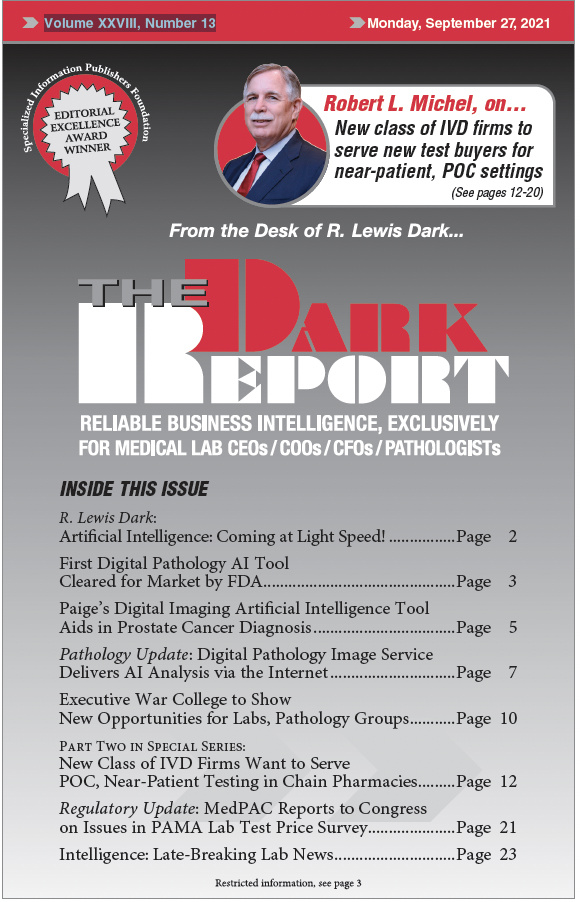

CEO SUMMARY: Our second installment in this series describes an emerging new class of in vitro diagnostics (IVD) companies. These companies have analyzers and tests designed specifically to be simple to run, generate results in minutes, use small sample sizes, and cost less than even high-volume routine tests run in core labs. These new IVD competitors …

New Class of IVD Firms Wants to Serve POCT in Near-Patient Settings Read More »

To access this post, you must purchase The Dark Report.