HCA WANTS TO BUY HEALTH MIDWEST FOR $1.25 BILLION FOR-PROFIT HOSPITAL BEHEMOTH HCA Inc. announced an agreement in principal to acquire Health Midwest, a 14-hospital system based in Kansas City, Missouri. Subject to further negotiations and due diligence, HCA will pay an estimated $1.25 billion for Health Midwest. HCA also committed to a five-year capital …

HCA, Tenet , Specialty Labs Read More »

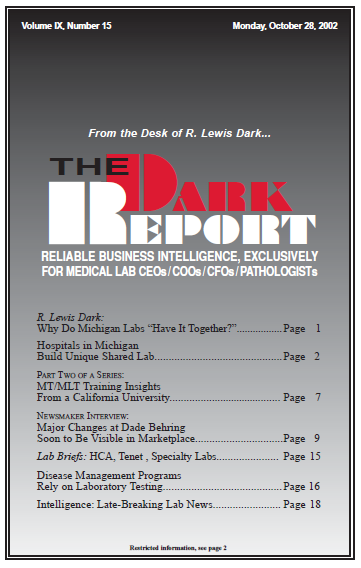

To access this post, you must purchase The Dark Report.