PUBLICLY TRADED LABORATORY COMPANIES OFFERED INSIGHTS into how acquisitions of hospital lab operations and outreach businesses add to their bottom lines, according to recent reports on full-year 2022 and fourth quarter earnings. Last year was a busy one for the billion-dollar lab corporations in terms of acquisitions. These huge laboratory companies are on the prowl …

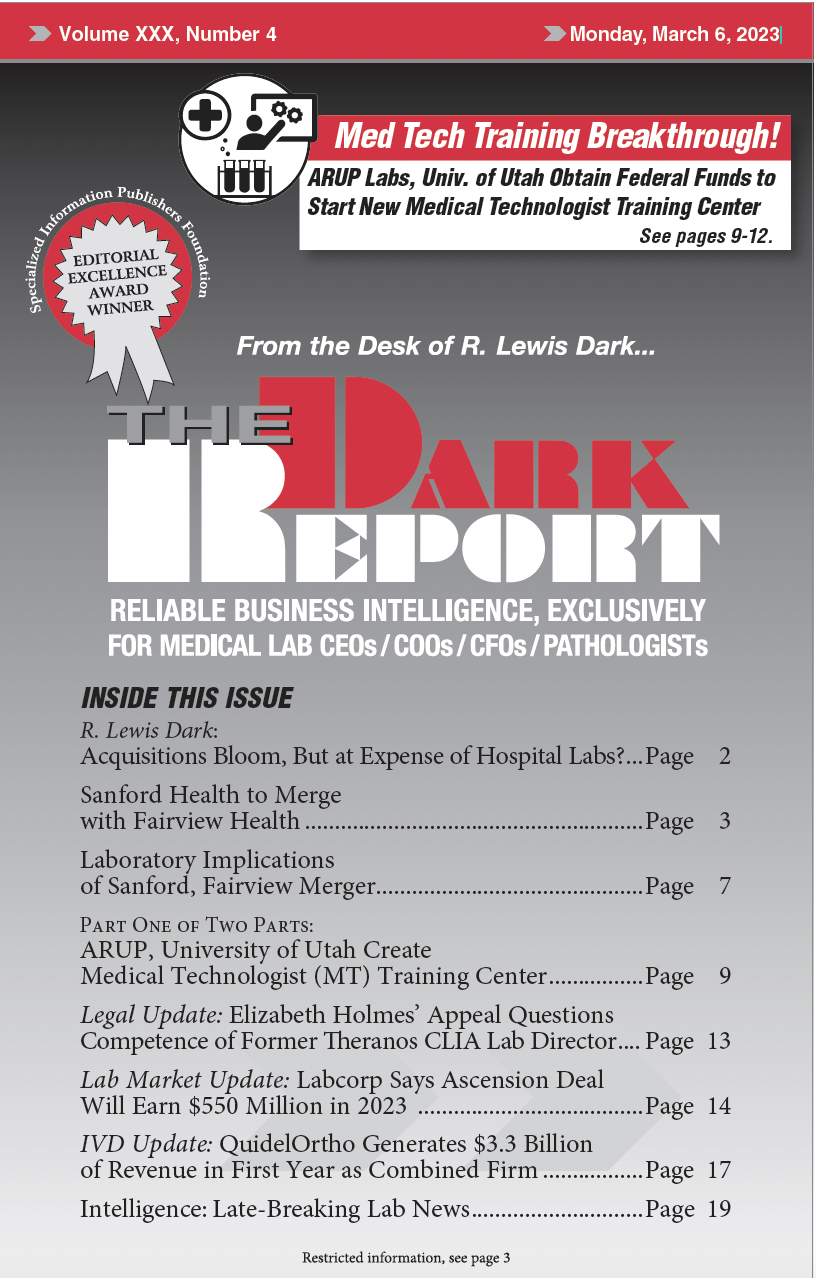

Labcorp: Ascension Deal Will Earn $550 Million in 2023 Read More »

To access this post, you must purchase The Dark Report.