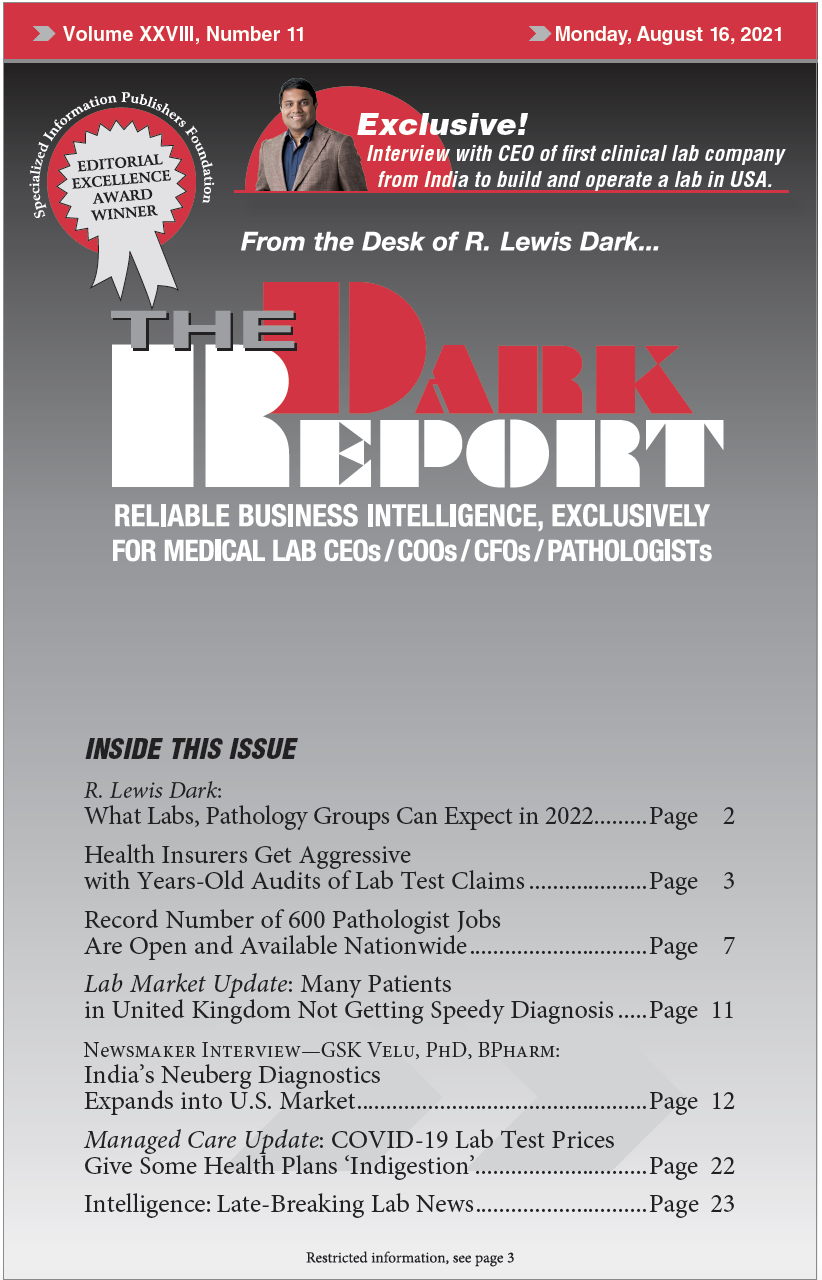

“Our idea is to enhance the access and affordability for next-generation techniques, meaning molecular diagnostics, genomics, pathology, digital pathology, proteomics, metabolomics, and all that. This is the spirit behind Neuberg Diagnostics. —GSK Velu, PhD, BPharm CEO SUMMARY: India is a nation where 50,000 pathology labs operate to serve the clinical laboratory testing needs of 1.4 …

India’s Neuberg Diagnostics Expands into U.S. Market Read More »

To access this post, you must purchase The Dark Report.