CEO SUMMARY: It will certainly rank as one of the major executive frauds in the clinical laboratory industry. In the wake of MEDex Laboratories’ Chapter 11 Bankruptcy filing in April, an amazing tale of deceit and deception began unfolding. At the center of the story is ex-MEDex CEO Michael E. Ladd, now cooling his heels …

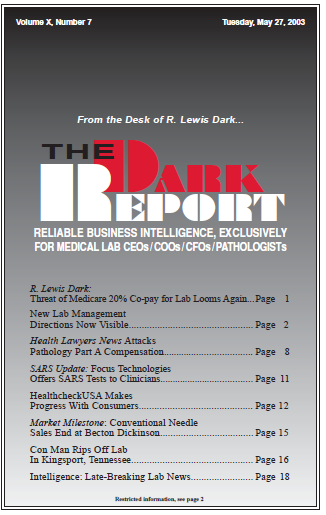

Con Man Rips Off Lab In Kingsport, Tennessee Read More »

To access this post, you must purchase The Dark Report.