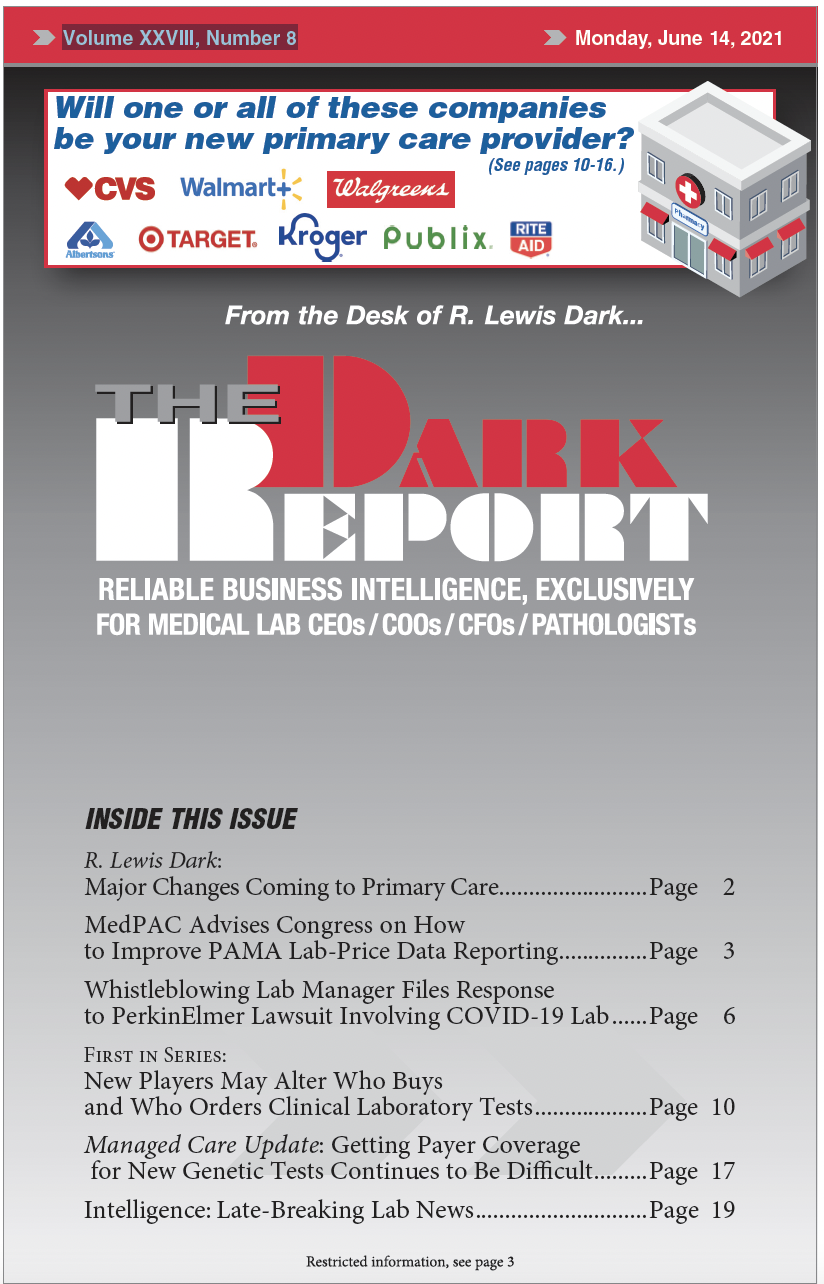

This is an excerpt of a 2,445-word article in the June 14, 2021 issue of THE DARK REPORT (TDR). The full article is available to members of The Dark Intelligence Group. CEO SUMMARY: This first installment in our series describes why market forces are at work to create a new player in healthcare that will …

New Primary Care Providers May Change Who Buys & Who Orders Lab Tests Read More »

To access this post, you must purchase The Dark Report.