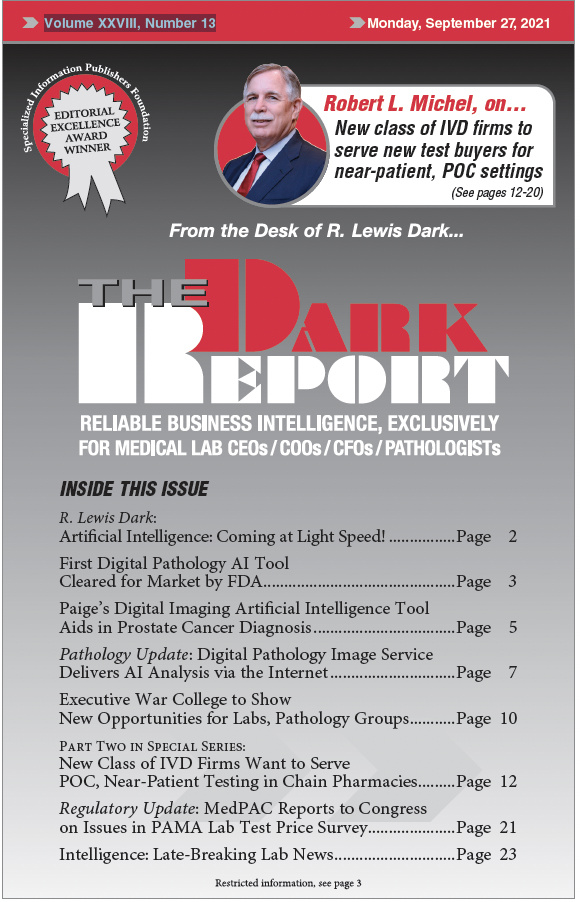

This is an excerpt of a 3,644-word article in the September 27, 2021 issue of THE DARK REPORT (TDR). The full article is available to members of The Dark Intelligence Group. CEO SUMMARY: Our second installment in this series describes an emerging new class of in vitro diagnostics (IVD) companies. These companies have analyzers and …

New Class of IVD Firms Wants to Serve in Near-Patient Settings Read More »

To access this post, you must purchase The Dark Report.