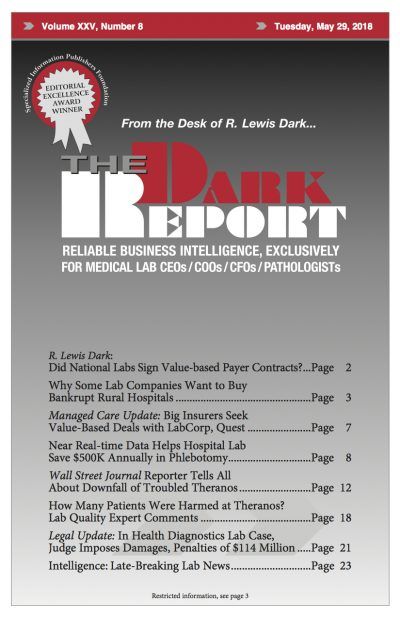

This is an excerpt from a 2,000-word article in the May 29, 2018 issue of THE DARK REPORT. The complete article is to all readers as long as the article limit has not been reached, and always available to paid members of the Dark Intelligence Group. CEO SUMMARY: Seeking the higher lab-test payment rates that …

Lab companies and bankrupt hospitals: Dancing around medical billing fraud Read More »

To access this post, you must purchase The Dark Report.