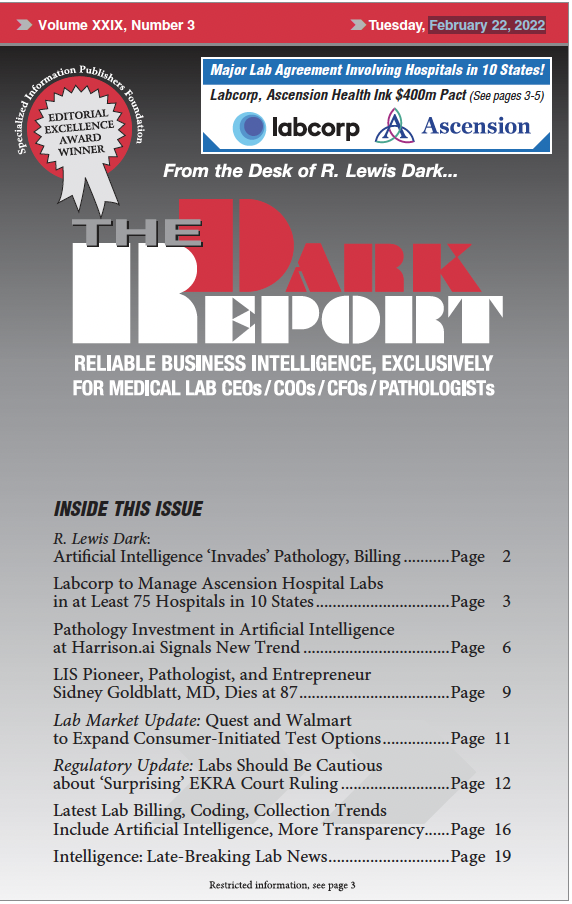

CEO SUMMARY: In a blockbuster deal valued at almost half a billion dollars, Labcorp will manage dozens of hospital labs in 10 states on behalf of Ascension Health, one of the biggest health systems in the country. Labcorp will also spend $400 million to acquire certain assets of Ascension’s outreach laboratory services. Labcorp’s CEO characterized …

Labcorp to Buy Outreach, Manage Ascension Labs Read More »

To access this post, you must purchase The Dark Report.