In a time of shrinking lab budgets and falling prices for lab tests in the United States, how are the larger in vitro diagnostic (IVD) manufacturers doing? A look at third-quarter financial reports provides useful insights as to which segments within the IVD industry are doing better than others. In alphabetical order, here’s a quick …

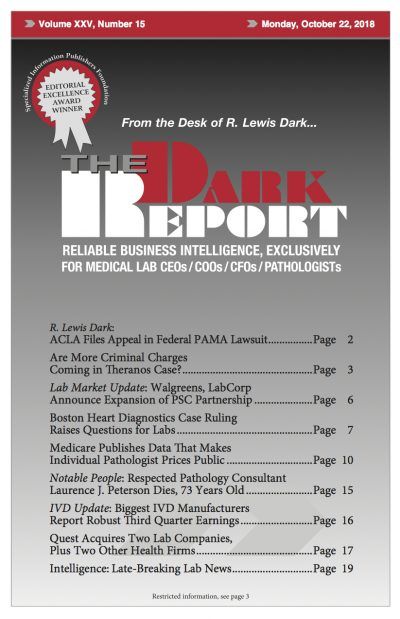

Biggest IVD Manufacturers Report Robust Third Quarter Earnings Read More »

To access this post, you must purchase The Dark Report.