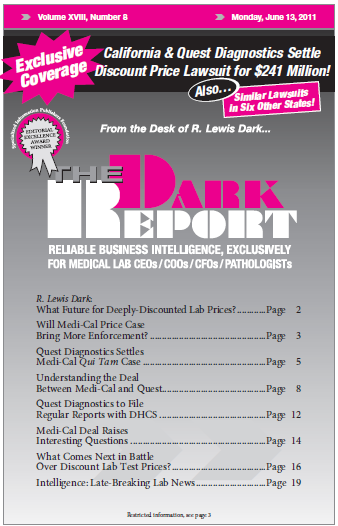

CEO SUMMARY: Now that the settlement involving Quest Diagnostics Incorporated and the California Attorney General has been announced, attention turns to what comes next with the four remaining defendant lab companies in the whistle-blower lawsuit. There are several different scenarios and it may be that California regulators face tough challenges before they can succeed in …

What Comes Next in Battle Over Discount Lab Prices? Read More »

To access this post, you must purchase The Dark Report.