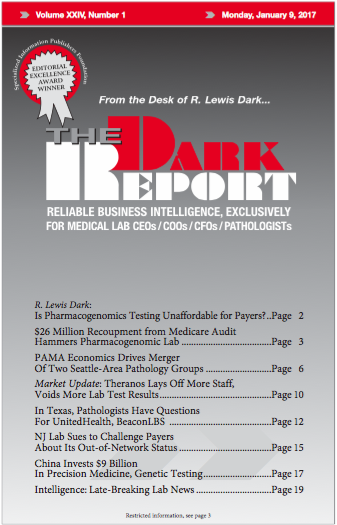

CEO SUMMARY: After Pharmacogenetics Diagnostic Laboratory LLC was audited by a Medicare Zone Program Integrity Contractor (ZPIC), it faced a $26 million repayment demand. The lab company appealed and asked for a redetermination, then filed for Chapter 11 bankruptcy protection. These developments should be a concern to all labs offering pharmacogenomic testing to Medicare patients. […]

To access this post, you must purchase The Dark Report.