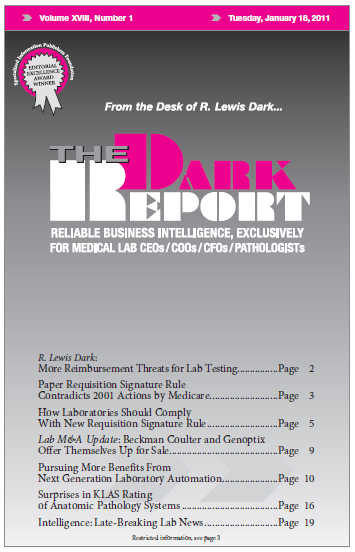

FOR DIFFERENT REASONS, last month two large companies in the lab industry put themselves up for sale. Assuming that both companies are sold, one consequence may be further consolidation in both the in vitro diagnostics (IVD) manufacturing sector and the lab testing sector. It was on December 9, 2010, when news broke that Beckman Coulter …

Beckman Coulter and Genoptix Offer Themselves Up for Sale Read More »

To access this post, you must purchase The Dark Report.