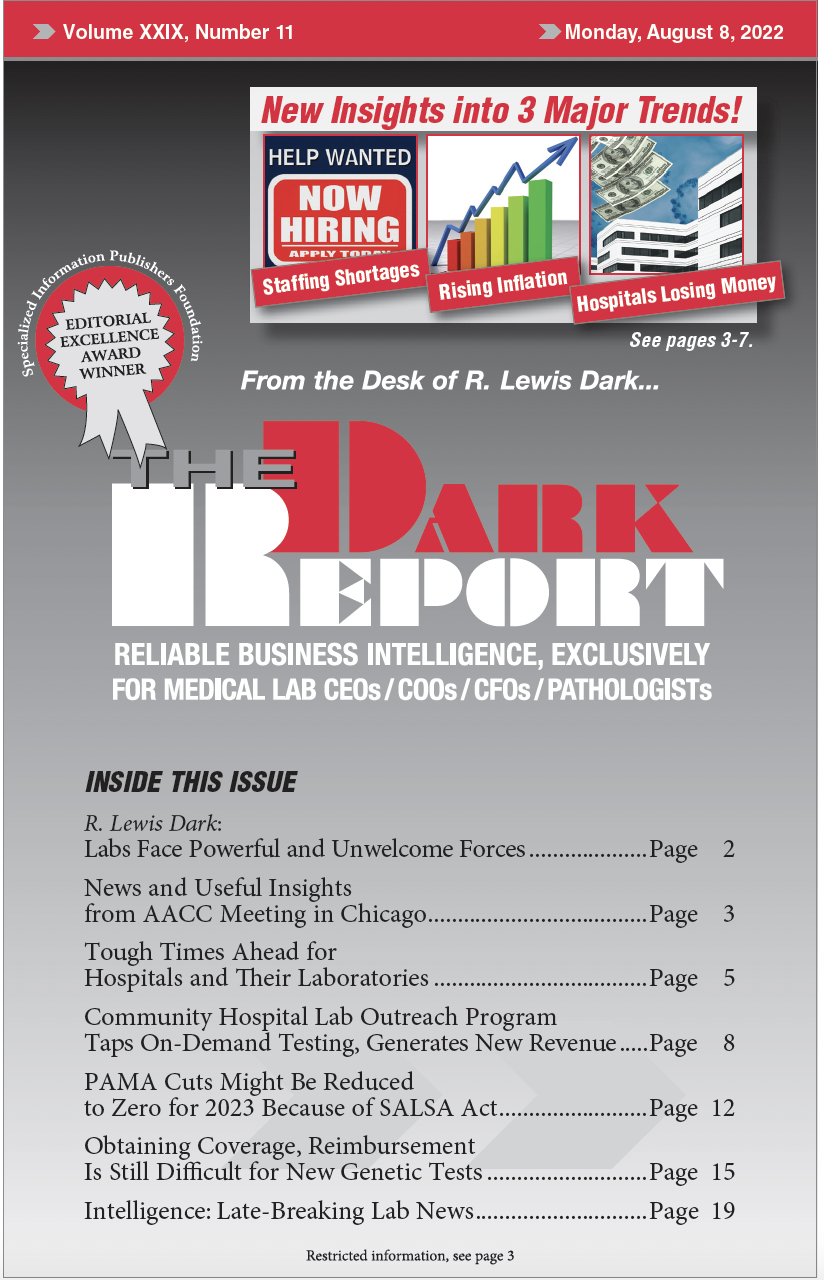

This is an excerpt of a 1,584-word article in the August 8, 2022 issue of THE DARK REPORT. The full article is available to subscribers. CEO SUMMARY: These are challenging times for the nation’s hospitals, health systems, and clinical labs. A perfect storm of three lab market forces involving unprecedented shortages of lab staff, nurses, …

Powerful Lab Market Forces Impacting the Industry Read More »

To access this post, you must purchase The Dark Report.