In RECENT WEEKS, public laboratory companies have released earnings reports for the year-ending December 31, 2004. It was generally a good year for the three largest lab companies that have a major emphasis on providing lab testing services to office-based physicians. In this year’s review, THE DARK REPORT looks at Quest Diagnostics Incorporated, Laboratory Corporation …

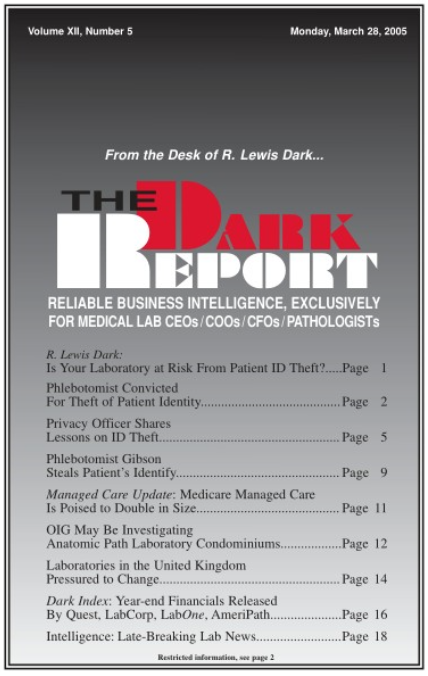

Year-end Financials Released For Quest, LabCorp & LabOne Read More »

To access this post, you must purchase The Dark Report.