IN RECENT WEEKS, TWO BIG PLAYERS spent billions to buy seats at the healthcare information technology (IT) table. Just one week apart, Xerox Corporation and Dell, Inc., acquired Affiliated Computer Services, Inc., and Perot Systems Corp., respectively. This rash of transactions is noteworthy for several reasons. One, it continues a trend of consolidation within the …

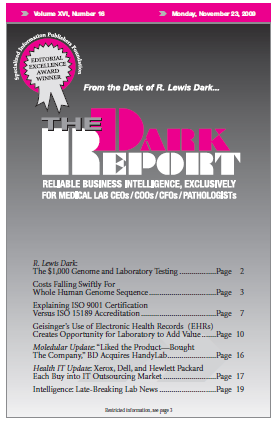

Xerox, Dell, and Hewlett-Packard Each Buy Into IT Outsourcing Market Read More »

To access this post, you must purchase The Dark Report.