CEO SUMMARY: In the space of just nine weeks, Siemens AG purchased Diagnostic Products Corp. (DPC) and Bayer Diagnostics. Siemens paid $1.86 billion and $5.31 billion, respectively, for the two invitro diagnostics (IVD) companies. Once it closes the acquisition of Bayer Diagnostics, Siemens will have the third largest IVD business in the world. Experts predict …

Siemens’ IVD Purchases Are a Major Investment Read More »

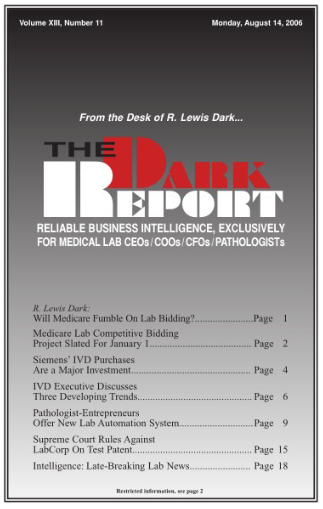

To access this post, you must purchase The Dark Report.