CEO SUMMARY: It’s a trend as yet invisible to the radar screens of most pathology groups. A new crop of specialty AP companies is targeting gastroenterology. In the past 36 months, several have posted phenomenal growth in both specimen volume and revenue. The heightened competition for GI biopsies mirrors that seen last decade for urology …

National AP Firms Target Gastroenterology Groups Read More »

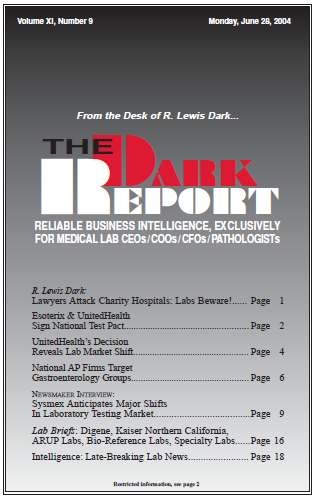

To access this post, you must purchase The Dark Report.