CEO SUMMARY: Pharmacogenomics, companion diagnostics, “personalized prescription drug therapy”—by any name, use of molecular diagnostics to guide clinicians in the prescribing and dosing of drugs is about to expand exponentially. Some experts predict that CYP450 testing alone will be a $1 billion business for labs in just a few years. Here’s a look at the forces driving this …

CYP450 Testing To Have Major Clinical Impact Read More »

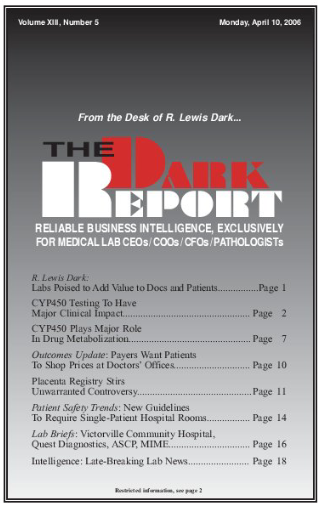

To access this post, you must purchase The Dark Report.