CEO SUMMARY: Because of Premier’s influence with 1,700 of the nation’s 5,000 hospitals, laboratory administrators and executives should realize that this strategic services alliance between Premier and Quest Diagnostics Incorporated will change traditional laboratory practices, regardless of whether the alliance proves successful or not. This interview with Premier Vice President John Biggers reveals the story …

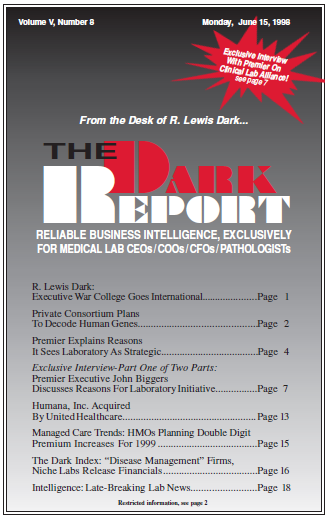

Premier Executive John Biggers Discusses Reasons For Laboratory Initiative Read More »

To access this post, you must purchase The Dark Report.