This story was updated from the original on March 27, 2019, and includes corrected information in three places. CEO SUMMARY: In their respective earnings reports for the fourth quarter and the full year of 2018, executives at both Laboratory Corporation of America and Quest Diagnostics told financial analysts that the Medicare fee cuts of 2017 …

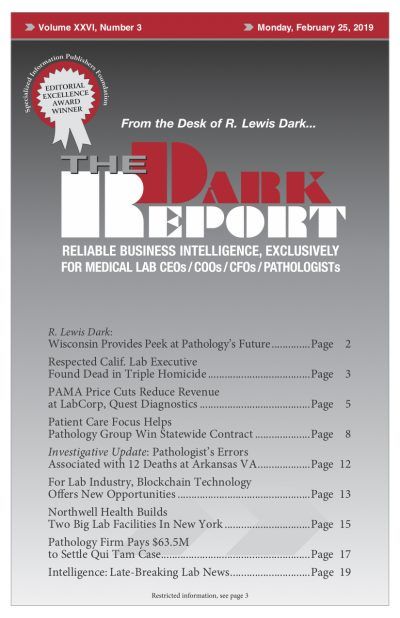

PAMA Price Cuts Reduce Revenue at LabCorp, Quest Read More »

To access this post, you must purchase The Dark Report.