IT IS THE NEXT STEP to continue diversifying its business away from clinical laboratory testing. On July 31, Laboratory Corporation of America announced that it would acquire Chiltern, a specialty contract research organization in London and Wilmington, N.C. LabCorp valued the all-cash transaction at about $1.2 billion and said it would fund the deal with …

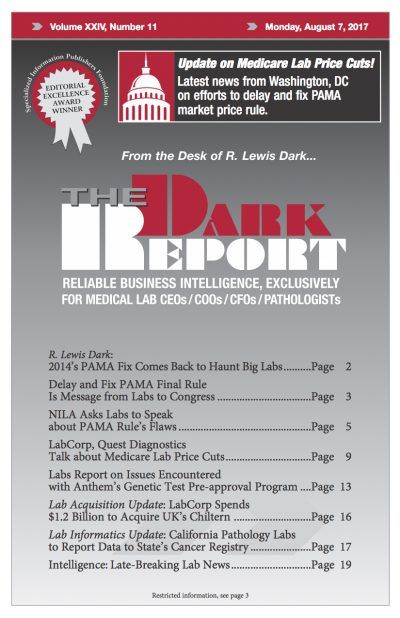

LabCorp Spends $1.2 Billion to Acquire UK’s Chiltern Read More »

To access this post, you must purchase The Dark Report.