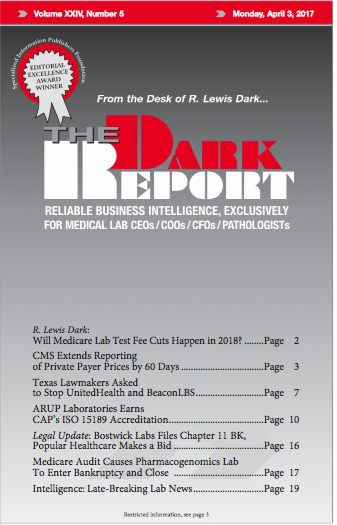

BANKRUPTCY IS THE LATEST CHAPTER in the business story of uropathologist David G. Bostwick, MD. On March 15, Bostwick Laboratories Inc. filed for Chapter 11 protection with the U.S. Bankruptcy Court for the District of Delaware. That same day, Poplar Healthcare, LLC, a specialty lab company in Memphis, agreed to buy the lab company in …

Bostwick Labs Enters Bankruptcy, Poplar Healthcare Makes a Bid Read More »

To access this post, you must purchase The Dark Report.