CEO SUMMARY: Consolidation in the LIS industry continued during 1997. The impact for laboratory buyers is that market share is concentrated among fewer vendors. Over the long term, this reduces choice and leads to an oligopoly-type of market. In the short-term, all LIS companies are competing aggressively to build market share. DURING 1997, Cerner Corp. …

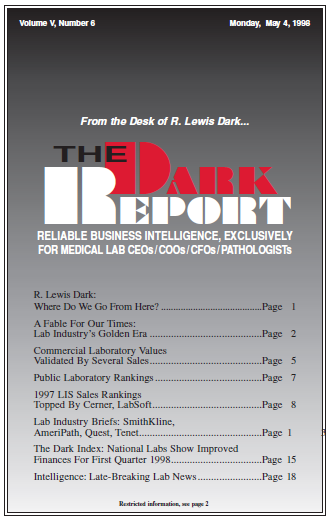

1997 LIS Sales Rankings Topped By Cerner, LabSoft Read More »

To access this post, you must purchase The Dark Report.