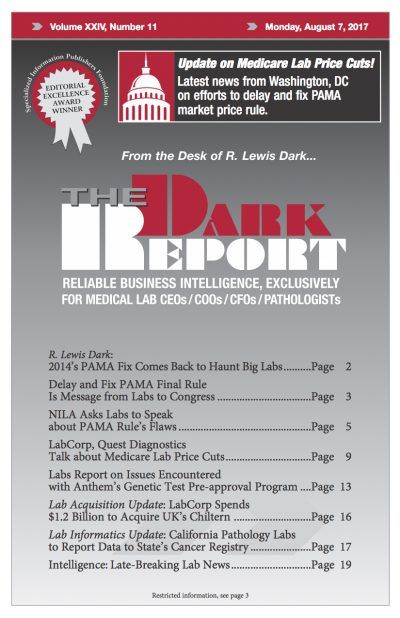

CEO SUMMARY: In an effort to forestall CMS’ efforts to implement the PAMA final rule on market price reporting, Laboratory Corporation of America and Quest Diagnostics are meeting with members of Congress, officials in the administration, and the new leadership of CMS. During recent conference calls, executives at both lab companies shared insights about these …

LabCorp, Quest Talk about Medicare Lab Price Cuts Read More »

To access this post, you must purchase The Dark Report.