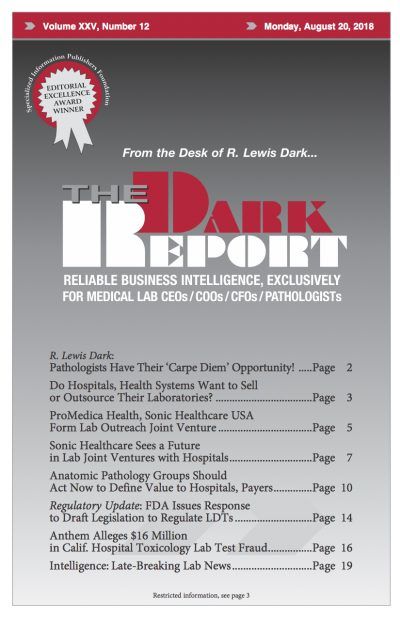

CEO SUMMARY: In a lawsuit filed in the U.S. District Court for the Central District of California, Anthem and affiliated Blue Cross Blue Shield plans alleged that 37-bed Sonoma West Medical Center, a Florida lab testing company, a medical billing company, and others used a pass-through lab test billing scheme to defraud Anthem and its …

Anthem Alleges $16M in Calif. Hospital Lab Fraud Read More »

To access this post, you must purchase The Dark Report.