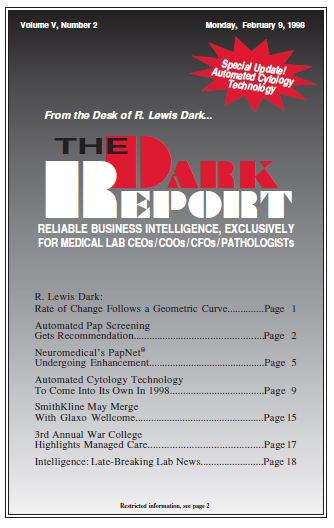

CEO SUMMARY: This is the year when automated cytology establishes itself. New companies will gain FDA approval and enter the marketplace during the next 18-24 months. Core technology will continue to evolve at a rapid rate. Pathologists and cytotechnologists will find themselves challenged to stay current with the pace of new product development. Because of …

Automated Cytology Technology To Come Into Its Own In 1998 Read More »

To access this post, you must purchase The Dark Report.