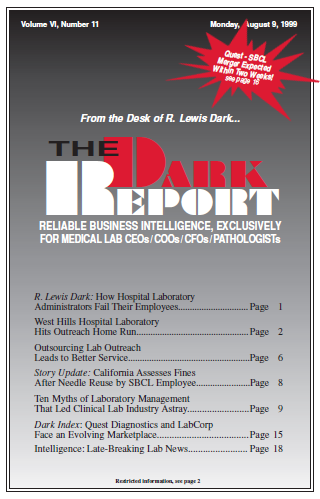

TWO OF THE THREE BLOOD BROTHERS reported continued improvement in their financial condition as second quarter earnings reports were made public. This news, however, was overshadowed by speculation about the failure of Quest Diagnostics Incorporated to consummate its purchase of SmithKline Beecham Clinical Laboratories (SBCL) during the month of July. Quest Diagnostics and Laboratory Corporation …

Quest Diagnostics and LabCorp Face an Evolving Marketplace Read More »

To access this post, you must purchase The Dark Report.