CEO SUMMARY: When it comes to competitive bidding for laboratory testing services, Medicare is no longer the only government health program looking to save money through this method. Florida’s Medicaid program and the British Columbia health system are both moving forward with plans to implement competitive bidding. Skyrocketing healthcare costs may make this an unstoppable …

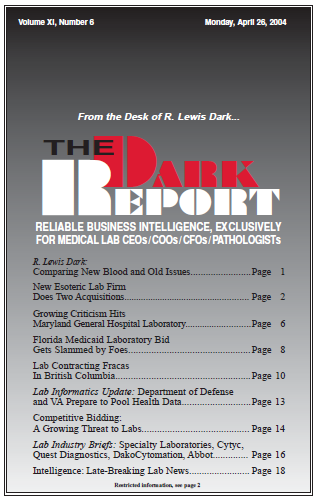

Competitive Bidding: A Growing Threat to Labs Read More »

To access this post, you must purchase The Dark Report.