CEO SUMMARY: There are several surprises in The Dark Report’s list of the Top 10 Lab Stories for 2020. Despite the SARS-CoV-2 pandemic dominating every aspect of clinical care, social life, and economic activities since March, at least one major health insurer pushed ahead with two major policies governing how labs can submit claims. In …

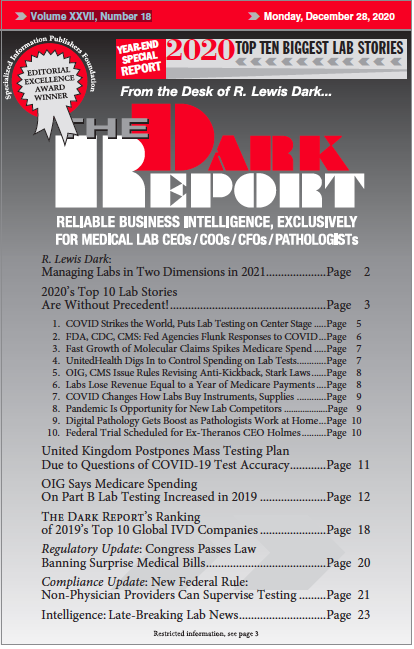

2020’s Top 10 Lab Stories Are Without Precedent! Read More »

To access this post, you must purchase The Dark Report.